Yes! You can use AI to fill out Form 130, Taxpayer's Notice to Initiate an Appeal

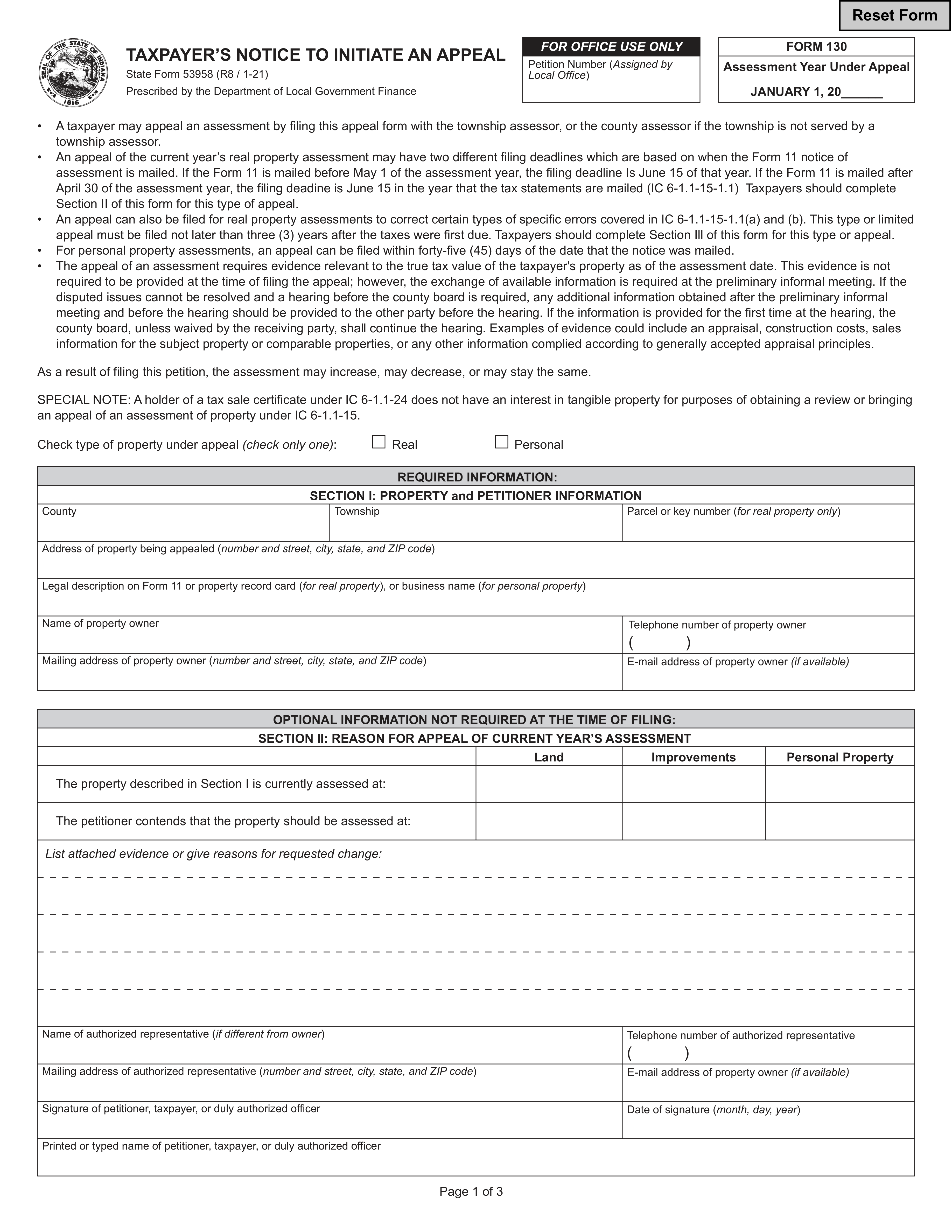

Form 130, Taxpayer Appeal Form, is a document that allows taxpayers to appeal their property assessments. It is important for taxpayers to fill out this form to ensure their property is assessed fairly and accurately, potentially affecting their tax liabilities.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Taxpayer's Notice to Initiate an Appeal using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 130, Taxpayer's Notice to Initiate an Appeal |

| Form issued by: | Department of Local Government Finance |

| Number of fields: | 74 |

| Number of pages: | 3 |

| Version: | 2021 |

| Official download URL: | https://www.uscis.gov/sites/default/files/document/forms/i-130.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Taxpayer's Notice to Initiate an Appeal Online for Free in 2025

Are you looking to fill out a TAXPAYER'S NOTICE TO INITIATE AN APPEAL form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your TAXPAYER'S NOTICE TO INITIATE AN APPEAL form in just 37 seconds or less.

Follow these steps to fill out your TAXPAYER'S NOTICE TO INITIATE AN APPEAL form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 130.

- 2 Enter property and petitioner information.

- 3 Provide reasons for the appeal.

- 4 Sign and date the form electronically.

- 5 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Taxpayer's Notice to Initiate an Appeal Form?

Speed

Complete your Taxpayer's Notice to Initiate an Appeal in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Taxpayer's Notice to Initiate an Appeal form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Taxpayer's Notice to Initiate an Appeal

The Taxpayer's Notice to Initiate an Appeal is used to start the appeal process for taxpayers who wish to contest a decision made by the assessor regarding their property assessment. Filing this notice is the first step in appealing an assessment, and it must be filed within the specified timeframe to be considered valid.

The deadline for filing a real property assessment appeal is generally 30 days from the mailing date of the notice of assessment. However, this timeframe may vary depending on the specific jurisdiction and the type of property being assessed. It is important to check with the local tax assessor's office for the exact deadline in your area.

The deadline for filing a personal property assessment appeal is typically the same as that for real property assessments, which is generally 30 days from the mailing date of the notice of assessment. However, some jurisdictions may have different deadlines for personal property assessments, so it is important to check with the local tax assessor's office for the exact deadline in your area.

Section I of the Taxpayer's Notice to Initiate an Appeal requires the taxpayer to provide their name, address, and contact information, as well as the parcel number or assessment roll number of the property being appealed. It is important to ensure that all required information is provided accurately and completely to ensure that the appeal process proceeds smoothly.

A regular appeal is a challenge to the assessed value of the property, while a correction of error appeal is used to correct factual errors or clerical mistakes on the assessment roll. Regular appeals are typically heard by a board of equalization or similar body, while correction of error appeals may be handled administratively by the assessor's office. It is important to understand the differences between these two types of appeals and to file the appropriate form based on the nature of the dispute.

The 'List attached evidence or give reasons for requested change' section of the Taxpayer's Notice to Initiate an Appeal form is where you provide evidence to support your appeal. This may include documents such as appraisals, sales contracts, tax bills, and other relevant information. Be sure to explain why you believe the assessment is incorrect and how the attached evidence supports your position. The more detailed and compelling your evidence, the stronger your appeal will be.

After the assessing official receives your appeal form and attached evidence, they will review the information and make a determination. They may request additional information or schedule a hearing to discuss the appeal in more detail. Once a decision has been made, you will be notified in writing of the outcome. If you disagree with the assessing official's decision, you can appeal to the County Property Tax Assessment Board of Appeals (PTABOA).

The County Property Tax Assessment Board of Appeals (PTABOA) is an independent body that hears and decides appeals of property tax assessments. The board is made up of citizens from the county who are trained to review property tax assessments and make fair and impartial decisions. PTABOA has the authority to reduce, increase, or affirm the assessed value of your property. If you are not satisfied with PTABOA's decision, you can appeal to the Indiana Board of Tax Review (IBTR).

If you are not satisfied with the decision of the County Property Tax Assessment Board of Appeals (PTABOA), you can appeal to the Indiana Board of Tax Review (IBTR). To do so, you must file a petition for review with IBTR within 30 days of PTABOA's decision. The petition should include the reasons for your appeal, any new evidence you wish to present, and a filing fee. IBTR will review your petition and may schedule a hearing to discuss your appeal. Once a decision has been made, you will be notified in writing of the outcome.

If you are not satisfied with the decision of the Indiana Board of Tax Review (IBTR), you can appeal to the Indiana Supreme Court. To do so, you must file a petition for review with the Supreme Court within 30 days of IBTR's decision. The petition should include the reasons for your appeal, any new evidence you wish to present, and a filing fee. The Supreme Court will review your petition and may grant a hearing or deny the appeal. If a hearing is granted, both sides will present arguments and evidence to the Court. Once a decision has been made, it is final and binding.

During a PTABOA hearing, taxpayers have the right to present evidence in support of their appeal. This may include documents, testimony from witnesses, or other forms of evidence that help to demonstrate that the assessed value of their property is incorrect. It is important to note that all evidence presented must be relevant to the issue being appealed and must be submitted in accordance with the rules and procedures established by the PTABOA.

If the PTABOA does not hold a timely hearing within 180 days of the filing of an appeal, the taxpayer may file a petition for review with the Indiana Tax Court. The Tax Court may then order the PTABOA to hold a hearing or may review the case on the record and make a decision based on the evidence already submitted. It is important for taxpayers to follow the proper procedures and deadlines in order to ensure that their appeal is processed in a timely and effective manner.

A three-member PTABOA is composed of three members appointed by the Indiana Department of Local Government Finance. Two members must be assessors or assessor's deputies from different counties, and one member must be a member of the public. The three-member PTABOA is responsible for hearing and deciding appeals of property assessments in most cases.

A five-member PTABOA is composed of five members appointed by the Indiana Department of Local Government Finance. Three members must be assessors or assessor's deputies from different counties, and two members must be members of the public. The five-member PTABOA is responsible for hearing and deciding appeals of property assessments in certain cases, such as those involving complex issues or large assessments.

The Indiana Tax Court plays a role in the property tax assessment appeal process by providing a higher level of review for decisions made by the PTABOA. Taxpayers who are dissatisfied with the decision of the PTABOA may file a petition for review with the Tax Court. The Tax Court may then review the record of the PTABOA hearing and make a decision based on the evidence presented. The Tax Court's decision is final and binding, unless further appeal is taken to the Indiana Supreme Court.

The burden of proof in a property tax assessment appeal lies with the taxpayer. However, if the assessor's action results in an assessment increase of more than 5%, the assessor may be required to provide evidence to support the new assessment. This is known as the 'presumptive correctness' standard, which assumes the assessment is correct until the taxpayer provides sufficient evidence to the contrary. The assessor must then prove the assessment is valid based on the evidence presented.

A taxpayer is an individual or entity that owns real property and is liable for paying property taxes on that property. A tax sale certificate holder, on the other hand, is an individual or entity that purchases a tax lien certificate at a tax sale auction when the property owner has failed to pay their property taxes. The certificate holder can then initiate the tax foreclosure process. In terms of appealing an assessment, a taxpayer has the right to appeal an assessment they believe is inaccurate or unfair. A tax sale certificate holder does not have the same right, as they do not own the property and have no direct interest in its assessment. Instead, they may be able to challenge the assessment if they can prove it directly impacts their ability to collect on the tax lien.

In the context of property tax assessments, assessor-appraisers are individuals who are certified to perform property appraisals for tax assessment purposes. The level of certification indicates the assessor-appraiser's level of education, experience, and expertise. A Level II assessor-appraiser has completed the required education and experience for the basic appraiser certification, but has not yet met the requirements for the Level III certification. A Level III assessor-appraiser, also known as a Certified Residential Real Property Review Appraiser or a Certified General Real Property Appraiser, has completed additional education, experience, and examination requirements beyond the Level II certification. Level III assessor-appraisers are qualified to appraise all types and sizes of real property, while Level II assessor-appraisers are typically limited to residential properties.

Compliance Taxpayer's Notice to Initiate an Appeal

Validation Checks by Instafill.ai

1

Filing Deadline Compliance

Ensures that the taxpayer's notice to initiate an appeal is submitted within the specified deadlines, which vary depending on the property type and the date when the Form 11 notice of assessment was dispatched. The system checks against a calendar to confirm that the appeal is timely and alerts if the submission falls outside the allowable window, potentially affecting the validity of the appeal.

2

Section I Completion and Accuracy

Confirms that Section I of the appeal form is thoroughly completed with precise information. This includes validation of the county, township, parcel or key number, property address, legal description or business name, as well as the property owner's name and mailing address. The system also ensures that contact details are provided and accurate, facilitating proper communication regarding the appeal.

3

Section II Proper Filling

Verifies that Section II is accurately filled out, detailing the type of property that is being appealed. The system checks that the current assessment is stated and that the petitioner's argument for the assessed value is clearly articulated, with supporting evidence or reasons for the requested change attached. This step is crucial for establishing the basis of the appeal.

4

Authorized Representative Information

Checks if Section II includes the name and contact information of an authorized representative, when such representation is applicable. The system ensures that this information is present and correct, enabling the representative to act on behalf of the petitioner in all matters related to the appeal.

5

Section III Error Correction Validation

Validates that Section III is completed correctly, particularly when the appeal is to correct an error as per IC 6-1.1-15-1.1(a) and (b). The system checks that the current assessment is listed, the petitioner's contention for the assessed value is provided, and the specific error made is clearly identified, ensuring compliance with the statutory requirements for such appeals.

6

Signature and Date Verification

The software confirms that the form has been signed and dated by the petitioner, taxpayer, or a duly authorized officer. It ensures that the signature is present and that the date is in a valid format, typically MM/DD/YYYY. The software also checks for the authenticity of the signature against known samples, if available, and alerts if the signature field is left blank or improperly filled.

7

Petition Number Section Check

The software ensures that the petition number section is left blank, as this is reserved for office use only. It verifies that no unauthorized markings or entries are made in this section by the applicant. If an entry is detected, the software flags this for review and correction to prevent processing delays or administrative issues.

8

Contact Information Accuracy

The software verifies that email addresses and telephone numbers are included if available. It checks the format of the email addresses to ensure they adhere to standard conventions and validates the telephone numbers against expected formats, including area codes. The software also highlights any missing contact information that could hinder communication.

9

Property Type Selection

The software checks that the appropriate box for the type of property under appeal, whether Real or Personal, is marked at the beginning of the form. It ensures that one, and only one, option is selected to avoid confusion or misrepresentation of the property type in question. The software also cross-references property records when possible to confirm the selection.

10

Appeal Process Understanding

The software confirms understanding of the appeal process by ensuring that all necessary sections related to the appeal procedures are completed. It includes checks for acknowledgment of preliminary informal meetings, PTABOA hearings, and further appeals to IBTR or Tax Court if necessary. The software also provides guidance on the steps required for a complete and valid appeal submission.

11

Verifies awareness of the roles of PTABOA and IBTR, and the burden of proof required

The AI ensures that the petitioner acknowledges the roles of the Property Tax Assessment Board of Appeals (PTABOA) and the Indiana Board of Tax Review (IBTR). It verifies that the petitioner understands the burden of proof lies with them to demonstrate the inaccuracy of the assessment. The AI checks for an indication of this awareness within the form, and it may prompt the user to review relevant information if such acknowledgment is missing or incomplete.

12

Ensures that the petitioner is aware that the assessment may increase, decrease, or stay the same as a result of filing this petition

The AI ensures that the petitioner is informed that the outcome of the appeal may result in an increased, decreased, or unchanged assessment. It checks for a statement or acknowledgment within the form that the petitioner has been apprised of this possibility. The AI aims to prevent any misunderstandings regarding the potential outcomes of the appeal process and may alert the petitioner if such a confirmation is not found on the form.

13

Checks for completeness and accuracy of all required fields and attachments

The AI meticulously scans the form to ensure that all required fields are completed accurately. It checks for the presence of necessary attachments and supporting documents that must accompany the form. The AI cross-references the provided information with known data formats and requirements to detect any discrepancies or omissions, prompting the user to correct or complete any missing or inaccurate information.

14

Validates that the form is submitted to the appropriate assessing official as per the instructions on the form

The AI validates that the form is directed to the correct assessing official or office as stipulated by the instructions. It may reference a database of appropriate contacts and addresses to ensure compliance with submission guidelines. The AI also checks the form for any specific submission instructions, such as deadlines or methods of delivery, and alerts the user if the current submission does not align with these instructions.

15

Ensures that all instructions and statutes related to the appeal process are reviewed and understood

The AI ensures that the petitioner has reviewed and understood all instructions and relevant statutes associated with the appeal process. It checks for confirmations or attestations within the form that indicate the petitioner's comprehension. The AI may provide additional resources or guidance to ensure the petitioner is fully informed about the legal and procedural aspects of their appeal.

Common Mistakes in Completing Taxpayer's Notice to Initiate an Appeal

Failing to submit the Taxpayer's Notice to Initiate an Appeal by the specified deadline can result in the dismissal of the appeal. It is crucial to be aware of the deadline, which is typically a fixed number of days after the assessment notice date. Taxpayers should mark their calendars and set reminders to ensure timely submission. To avoid this mistake, it is recommended to prepare the appeal well in advance and consider mailing it with a service that provides delivery confirmation.

Leaving property or petitioner information incomplete in Section I can lead to processing delays or even the rejection of the appeal. It is essential to double-check that all fields are filled out accurately, including the property address, owner's name, and contact details. Before submitting the form, review all entries to ensure completeness. Using a checklist of required information can help ensure that no details are overlooked.

Not specifying the type of property in Section II can cause confusion and hinder the appeal process. The form typically requires the taxpayer to classify the property as residential, commercial, industrial, or agricultural. To avoid this error, carefully read the instructions for Section II and select the appropriate property type. If uncertain about the correct classification, consult the assessment notice or reach out to the local tax assessor's office for guidance.

An appeal without supporting evidence for the contention that the property's assessed value is incorrect is likely to be unsuccessful. It is important to gather relevant documentation, such as comparable sales data, appraisals, or photographs, to substantiate the claim. Organize the evidence clearly and reference it in the appeal form. To prevent this mistake, prepare the evidence in advance and ensure it is readily available when filling out the form.

If a taxpayer is represented by an authorized individual, such as an attorney or tax agent, omitting this representative's contact information can lead to communication issues. Ensure that the representative's name, address, phone number, and email are provided in the designated section. This allows the appeals board to contact the representative directly with any questions or updates. To avoid this oversight, verify the representative's contact details before submitting the form and confirm that they are willing to act on the taxpayer's behalf.

Filling out the petition number section incorrectly can lead to processing delays or the appeal being misdirected. It is crucial to double-check the petition number for accuracy before submission. Ensure that the number matches the one provided in the initial assessment notice. If you are unsure of the petition number, contact the appropriate tax authority for confirmation. Always review the entire form for accuracy before submitting.

An unsigned or undated form is often considered incomplete and can result in the rejection of the appeal. Always remember to sign and date the form in the designated areas. Verify that the date corresponds with the actual day of signing to avoid any confusion. Keep a copy of the signed and dated form for your records. It is advisable to check the form for a signature and date as the last step before mailing or submitting it electronically.

Omitting details about the error in Section III can hinder the review process, as the authorities may not understand the basis for the appeal. Be specific and clear when describing the error you wish to correct. Provide all necessary details and reference any applicable laws or regulations that support your claim. If additional space is needed, attach a separate sheet with a full explanation. Review Section III thoroughly to ensure that your explanation is complete and understandable.

Neglecting to attach supporting documentation or evidence can weaken your appeal, as the tax authority relies on this information to make an informed decision. Gather all relevant documents before filling out the form. Make sure to reference these documents in the form where appropriate, and attach them securely. Keep copies of all documents for your records. Before submitting the form, double-check that all necessary attachments are included.

Selecting the incorrect box for the type of property can lead to misunderstandings regarding the appeal. Review the definitions of property types provided by the tax authority to ensure you are selecting the correct category. If you are uncertain about which box to check, seek guidance from a tax professional or the issuing authority. After making your selection, review the form to confirm that the correct box is checked. Correctly identifying the property type is essential for the appeal to be assessed properly.

Failing to comprehend the roles of the Property Tax Assessment Board of Appeals (PTABOA) and the Indiana Board of Tax Review (IBTR) can lead to confusion about the appeal process and the appropriate steps to take. It is crucial for taxpayers to recognize that the PTABOA is the first level of appeal where they can present their case, while the IBTR is the next level if further appeal is necessary. To avoid this mistake, taxpayers should thoroughly research or seek guidance on the specific functions and jurisdictions of these bodies before initiating an appeal. Understanding the hierarchy and the role of each entity ensures that the appeal is directed to the correct authority and that the taxpayer is prepared for the process.

Taxpayers often initiate an appeal without a clear understanding of the potential outcomes, which can lead to unrealistic expectations or unpreparedness for the result. It is important to be aware that the appeal could result in a decrease, increase, or no change to the assessed value of the property. Before filing an appeal, taxpayers should consider consulting with a tax professional or legal advisor to gain insight into the possible outcomes and to develop a well-informed strategy. This preparation can help manage expectations and ensure that the taxpayer is ready for any adjustments that may result from the appeal.

Overlooking the review of relevant statutes and deadlines is a common mistake that can lead to the dismissal of an appeal. Each jurisdiction has specific legal requirements and time frames within which an appeal must be filed. To prevent this error, taxpayers should carefully read the governing statutes and mark all critical deadlines on their calendar well in advance. Seeking clarification from local tax authorities or legal counsel can also help ensure compliance with all procedural requirements. Adhering to the established timelines and legal guidelines is essential for a valid and timely appeal.

Submitting the Taxpayer's Notice to Initiate an Appeal to the incorrect assessing official can delay the process or result in the appeal not being heard. It is imperative to identify and verify the correct official or department responsible for handling appeals in the specific jurisdiction. Taxpayers should double-check the address and contact information for the assessing official provided on the form or on the official government website. If there is any uncertainty, contacting the local assessor's office for confirmation can prevent this mistake. Accurate submission ensures that the appeal is processed in a timely and efficient manner.

Omitting contact information such as email addresses and telephone numbers can hinder communication regarding the appeal. This information is essential for the assessing officials to reach out to the taxpayer with updates, requests for additional information, or scheduling of hearings. Taxpayers should ensure that all contact fields are filled out completely and legibly on the appeal form. It is also advisable to provide multiple forms of contact to facilitate easier communication. Keeping contact information up to date and checking it regularly will help maintain an open line of communication throughout the appeal process.

Incorrectly classifying the property type can lead to processing delays and potential rejection of the appeal. It is crucial to accurately determine whether the property in question is real property, such as land and buildings, or personal property, which includes movable items like vehicles and equipment. To avoid this mistake, carefully review the definitions of real and personal property provided by the tax authority. Double-check the classification against your property records and consult with a professional if you are uncertain about the correct category for your property.

An appeal without a strong justification for the requested change in valuation or assessment is likely to be unsuccessful. It is essential to provide clear and compelling evidence to support your claim. To prevent this oversight, gather relevant documentation, such as comparable property assessments, market analyses, or expert appraisals. Make sure to articulate the reasons for your appeal logically and coherently, linking your evidence directly to the points of contention.

Skipping preliminary informal meetings with the assessor can be detrimental to your appeal process. These meetings are an opportunity to resolve disagreements without formal proceedings. To avoid this misstep, make it a priority to attend all scheduled meetings. Prepare for the discussions by reviewing your property assessment and compiling any questions or concerns you may have. Engaging in these meetings can lead to a quicker and more favorable resolution.

Underestimating the burden of proof needed to support your appeal can result in an unfavorable outcome. The taxpayer is typically responsible for proving that the assessment is incorrect. To address this, thoroughly prepare your case by collecting all necessary evidence and organizing it in a clear and persuasive manner. Consider consulting with a tax professional or attorney who can help you understand the burden of proof and assist in building a strong case.

Neglecting to consider the option of further appeals to the Indiana Board of Tax Review (IBTR) or Tax Court can limit your chances for a successful resolution. If the initial appeal does not yield the desired result, be aware of the additional steps available. Familiarize yourself with the timelines and requirements for filing further appeals. Keep track of all correspondence and decisions related to your case, and seek legal advice to navigate the appeals process effectively.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Taxpayer's Notice to Initiate an Appeal with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 130 forms, ensuring each field is accurate.